Adjustable-Rate Mortgage

Is an Adjustable-Rate Mortgage Right for You?

In this highly competitive real estate market, home ownership may seem out of reach, especially for the first-time homebuyer. An ARM offers a more flexible approach when compared with traditional fixed-rate mortgages.An adjustable-rate mortgage makes sense if you plan to sell before the fixed period ends, expect income growth or want lower payments now with the flexibility to refinance later. ARMs could also be a good option in a high-interest market with the possibility to refinance later if rates drop.

ARM features:

- Competitive rate

- No Points

- Loans up to 97%* of the appraised value of your home (excluding liens and seconds)

- Low down-payment options available

- No pre-payment penalty or negative amortization

- Loan amounts up to $1,000,000

5/1 Adjustable-Rate Mortgage (ARM) Rate Information:

| Term | Start Rate | APR* | Points (%) | Margin | Index | Initial Cap | Periodic Cap | Lifetime Cap | Est. Monthly Payment |

|---|---|---|---|---|---|---|---|---|---|

| 30-Year | As low as 5.750% | As low as 5.793% | 0.000% | 2.250% | 1-Year CMT | 2.000% | 2.000% | 5.000% | **See example below. |

We are here to help you find the right home loan option that works for you. Please call us at 866.445.9828 and ask to speak to a Real Estate Loan Representative.

CLICK HERE TO APPLY FOR A FIRST MORTGAGE LOAN

*APR=Annual Percentage Rate

**5/1 Adjustable-Rate (ARM) additional information and example:

Primary Owner-Occupied Properties only. Second/Vacation homes and Investment properties are not eligible.

Index: The weekly average yield on the U.S. Treasury Securities adjusted to constant maturity of one year, commonly known as 1-year CMT. As of 12/26/2025, the index = 3.490.

No Balloon Payment:The 5/1 ARM loan will be fully amortized over 30 years and features a fixed rate for the first 5 years followed by potential rate and payment adjustments every 12 months.

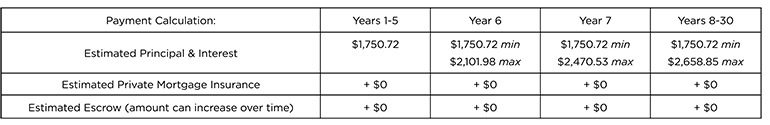

Example: Payment examples are based on a set of loan assumptions that include a borrower with excellent credit (740 credit score or higher), a loan amount of $300,000,a loan to value(LTV) of 80% or less, and one-unit property that is a primary residence. Payments do not include amounts for PMI, taxes and insurance premiums, but if applicable, the actual payment obligations will be greater.

*Loans over 80% LTV require mortgage insurance. Loans subject to borrower and property qualifications. Not all applicants will be approved. Other restrictions may apply.

ILWU Federal Credit Union NMLS #450072. Mortgage Loan Originators